The Basic Principles Of Vancouver Accounting Firm

Wiki Article

The Definitive Guide for Pivot Advantage Accounting And Advisory Inc. In Vancouver

Table of ContentsExcitement About Vancouver Accounting FirmNot known Details About Tax Consultant Vancouver The Facts About Virtual Cfo In Vancouver RevealedThe Single Strategy To Use For Small Business Accountant Vancouver

That happens for each single transaction you make throughout an offered audit period. Your bookkeeping duration can be a month, a quarter, or a year. It all comes down to what works best for your organization. Dealing with an accounting professional can aid you hash out those details to make the accountancy process help you.

What do you do with those numbers? You make modifications to the journal entrances to make certain all the numbers add up. That might include making improvements to numbers or handling accrued products, which are expenses or earnings that you sustain however don't yet pay for. That obtains you to the readjusted trial balance where all the numbers accumulate.

Bookkeepers as well as accountants take the very same foundational audit courses. This overview will give a comprehensive break down of what separates accountants from accounting professionals, so you can comprehend which bookkeeping function is the best fit for your job aspirations currently and in the future.

Top Guidelines Of Vancouver Tax Accounting Company

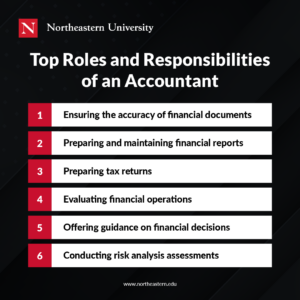

An accounting professional improves the information provided to them by the accountant. Commonly, they'll: Testimonial economic statements prepared by a bookkeeper. Evaluate, translate or testify to this info. Turn the details (or records) into a report. Share advice and make suggestions based upon what they've reported. The records reported by the accountant will determine the accounting professional's guidance to leadership, as well as eventually, the wellness of the service overall.e., federal government companies, colleges, health centers, and so on). An experienced and experienced bookkeeper with years of experience as well as first-hand expertise of accounting applications ismost likelymore certified to run guides for your company than a current bookkeeping significant graduate. Maintain this in mind when filtering system applications; attempt not to evaluate candidates based upon their education and learning alone.

Future forecasts as well as budgeting can make or break your company. Your monetary records will certainly play a massive function when it concerns this. Service projections as well as fads are based upon you can try these out your historical economic information. They are required to aid ensure your service stays profitable. The economic information is most trusted and also exact when given with a robust as well as structured bookkeeping process.

Tax Consultant Vancouver for Dummies

An accountant's task is to maintain complete documents of all cash that has come right into as well as gone out of the business. Their records allow accounting professionals to do their tasks.Typically, an accounting professional or owner oversees an accountant's job. An accountant is not an accounting professional, neither need to they be taken into consideration an accountant. Bookkeepers record financial purchases, post debits as well as credit histories, create invoices, manage pay-roll as well as keep and also balance guides. Bookkeepers aren't called for to be certified to deal with the publications for their consumers or company yet licensing is available.

3 primary variables influence your expenses: the services you want, the experience you need as well as your neighborhood market. The bookkeeping services your organization requirements as well as the amount of time it takes weekly or month-to-month to finish them impact just how much it costs to work with a bookkeeper. If you need somebody ahead to the workplace once a month to resolve the books, it will set you linked here back much less than if you require to work with a person full time to handle your daily procedures.

Based upon that estimation, choose if you need to work with someone full time, part-time or on a task basis. If you have complex books or are bringing in a great deal of sales, work with a certified or accredited accountant. A knowledgeable accountant can provide you assurance and confidence that your finances are in excellent hands yet they will also cost you extra.

Things about Pivot Advantage Accounting And Advisory Inc. In Vancouver

If you live in a high-wage state fresh York, you'll pay more for a bookkeeper than you would certainly in South Dakota. According to the Bureau of Labor Data (BLS), the nationwide typical income for accountants in 2021 was $45,560 or $21. 90 per hour. There are several benefits to working with a bookkeeper to file as well as record your company's financial records.

Then, they might seek additional certifications, such as the CPA. Accounting professionals might likewise hold the position of accountant. If your accounting professional does your navigate to these guys bookkeeping, you might be paying even more than you must for this solution as you would usually pay even more per hr for an accountant than an accountant.

To finish the program, accountants have to have four years of pertinent work experience. CFAs must also pass a difficult three-part test that had a pass price of just 39 percent in September 2021 - Vancouver tax accounting company. The factor right here is that hiring a CFA means bringing highly sophisticated audit expertise to your company.

To obtain this certification, an accounting professional should pass the required examinations as well as have two years of expert experience. You may work with a CIA if you desire a more specialized focus on financial danger evaluation and also security tracking procedures.

Report this wiki page